Citation

L'auteur

Bruno CARBALLA SMICHOWSKI

(bruno.carballa@groupechronos.org) - Chronos

Copyright

Déclaration d'intérêts

Financements

Aperçu

Contenu

Data sharing as coopetition in MaaS schemes

Coopetition, understood as “a system of actors that interact on the basis of partial congruence of their interests and goals” (Dagnino, Le Roy, & Yami, 2007) by simultaneously competing and cooperating is a subject on which the management literature has been increasingly focusing since the appearance of Nalebuff and Brandenburger’s (1997) book put it on the radar. Since then, coopetitive practices have been studied mostly “in the context of knowledge-intensive, dynamic, and complex industries” (Bouncken, Gast, Kraus, & Bogers, 2015), in which they are more prevalent.

Nevertheless, little attention has been paid to how the concept of coopetition can shed some light to understand the increasingly common practices of data sharing between competing firms. Within these practices, data sharing in the context of the nascent “mobility-as-a-service” (MaaS) schemes constitute a particularly interesting field to understand data-related coopetitive dynamics. There is not a consensual definition of MaaS (Jittrapirom et al., 2017), as the phenomenon and the term itself, coined by Hietanen (2014), is only four years old. We will adopt the strictest definition, which implies the presence of several means of transportation in a single digital interphase (typically an app) managed by a “mobility aggregator” that combines several transportation services and offers end users real-time information, trip planning, booking, ticketing, and payment functionalities (CIVITAS, 2016). We have chosen this definition of MaaS because schemes that imply a high level of integration are the richest in terms of coopetitive dynamics between transportation operators. Regarding data sharing in MaaS, it should be noted that transportation operators rarely share their data with each other, but rather give access to some of their data to the mobility aggregator that manages the data exchange between the multiple service providers through application programming interfaces.

While it is clear that data is at the core of value creation in MaaS business models, the outcomes of these models in terms of value capture are less clear because the data sharing they entail gives birth to a classic coopetitive dilemma. On the one hand, each operator needs to cooperate by sharing data with competitors for the service to exist and, in that manner, attract more clients by creating more value for end users. In that manner, cooperation through data sharing makes of data in MaaS both “leverage and opportunity” and a strategic asset (Chignard & Benyayer, 2015) in that its sharing allows to create revenue for transportation operators and the mobility aggregator in as much as it helps the former to defend their position in the market. On the other hand, this cooperation might, in the short-run, divert clients to competitors and, in the long-run, result in mobility aggregators gaining sufficient knowledge about transportation operators to enter their markets.

We are therefore in presence of a textbook case of coopetition that, to our knowledge, has not been studied as such so far. This coopetitive dilemma is in as much as interesting as it involves three types of actors within the transportation industry: brick-and-mortar incumbent operators (e.g. railway operators), new entrant digital operators (e.g. ride-hailing apps) and third-party aggregators (e.g. Whim).

Under which conditions will transportation providers decide to coopete by sharing data in the context of a MaaS scheme? The goal of this article is to answer this question by focusing on the incentives transportation operators have to share data. In order to do so, we will build on microeconomic theory and the experiences of the existing operating and pilot MaaS schemes.

The coopetitive dynamics of data sharing in MaaS

As mentioned above, MaaS schemes require transport providers to coopete through data sharing, which creates a tension between value creation and value appropriation characteristic of coopetition (Bengtsson & Kock, 2000). Nevertheless, certain economic properties of the data required to set up a MaaS scheme invite us to go further in the analysis of this dilemma in order to understand how operators will respond to it.

First, when intermodal competition takes place, transportation operators compete at the route level (Bataille & Steinmetz, 2013). In route competition, firms compete on five dimensions: the design of the routes, schedules, price, travel time and quality. This implies that two transportation operators might compete in certain routes and not in others. For example, the railway company SNCF competes strongly with the carpooling app BlaBlaCar in the Paris-Lille route, since the time and the price they both offer in that route are comparable. Nevertheless, for the opposite reason, they hardly compete in the Paris-Budapest route. Moreover, transportation operators might compete only during certain times of the day in a certain route. For example, ride-hailing apps compete with metro lines during the day, but not at night, when the metro does not run. In terms of the coopetitive dilemma, this means that the risk of losing rides to coopetitors by sharing data with them depends on how overlapping the routes of a firm are with those of other firms within the MaaS scheme in terms of the design of the route, schedules (or availability in the case of on-demand mobility services) and travel time. Symmetrically, the possibility of winning clients by sharing data with coopetitors depends on how complementary the routes are in creating demanded intermodal routes for end users. Because data about every route in the territory covered by the MaaS scheme needs to be shared for it to function, transportation operators constantly and intermittently collaborate and compete when they share data.

Second, because some transportation services are more essential than others to move around a certain territory, if firms that hold data about them do not cooperate by sharing it, the MaaS scheme cannot exist. Otherwise, the latter would just be of little use to final users. This implies that these ‘key transportation operators’ need to be able to obtain more rides by being in the MaaS scheme than by staying out of it, or to have other non-profit-oriented incentives, in order to decide to share their data.

Third, MaaS schemes can be considered to be multi-sided markets (Meurs & Timmermans, 2017), which can be defined as markets that mediate interactions between several ‘sides’ that benefit from positive indirect network effects. The latter exist when an increase in the number of users on one side raises the value for users on the other sides. In the case of MaaS, we can identify at least two sides: end users and transportation operators. Indirect network effects exist because the more transportation operators there are, the more attractive the service becomes for end users, since the number of intermodal routes increases, mobility options are diversified, transportation time is reduced and, depending on the pricing modalities, the final price can be lowered. Symmetrically, the more users there are in a MaaS scheme, the more attractive it becomes for an operator to join, as the chances of winning rides through intermodal connections with coopetitors increase. So does the opportunity cost of not being part of the MaaS scheme, since its users will only consider the transportation providers included in it. When transportation operators can gain more by sharing data in a MaaS scheme than by not sharing it, each of them can be considered to represent a side of the market that benefits from indirect network effects from the other sides, namely users and other transportation operators. In the next two sections, we will determine the conditions under which these positive network effects between transportation operators arise in MaaS, and therefore, transportation operators will decide to coopete through data sharing.

Conditions of data sharing for a single operator

Taking into account these three coopetitive dynamics of data sharing in the context of MaaS, we can determine the conditions under which a transportation operator will have incentives to share its data.

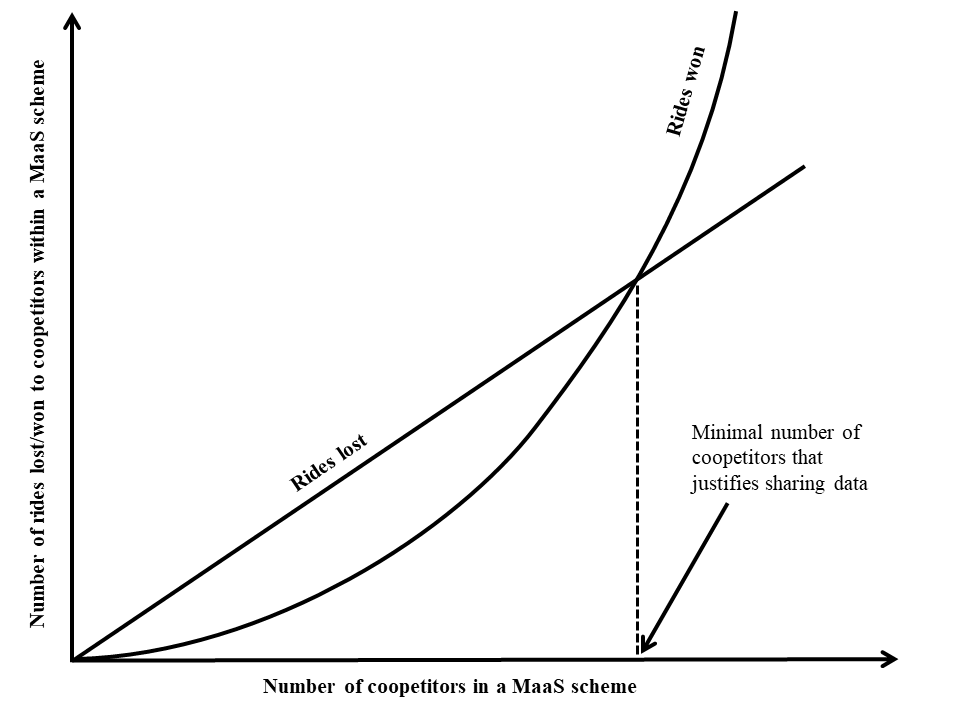

Figure 1. The choice of data sharing in the context of MaaS from the perspective of a single transportation operator

Figure 1 represents the coopetitive dilemma from the perspective of a single transportation operator. The positive slope of the straight line shows that, as more operators join the MaaS scheme, more rides are lost to them. We will call this the “losing rides through MaaS” effect. Then, the slope of this line depends on the level of overlapping between the operator’s routes and those of the new MaaS coopetitors in terms of route design, schedules (or availability in the case of on-demand mobility services), price and transportation time. The positive slope of the curve shows that, as more operators join the MaaS scheme, more rides will be won, as the user base and the possibility of intermodal connections coming from coopetitors routes will increase. We will call this the “winning rides through MaaS” effect. The slope of the curve depends therefore on the level of complementarity of the routes of coopetitors.

Let us point out that the choice of a straight line and an exponential curve to translate these two dynamics is only meant to simplify its graphical representation. Although these curves have by definition a positive slope, the slope could vary along the curve in many ways depending on the level of complementarity between the routes of the coopetitors joining the MaaS scheme. Nevertheless, we will argue that, for any operator, once a critical mass of coopeting operators in the MaaS scheme is reached, the “winning rides through MaaS” effect will prevail over the “losing rides through MaaS” one. There are several reasons for that. First there is the existence of increasing “positive external effects of individual routes on other routes” (Bataille & Steinmetz, 2013): as routes are added to a transportation network, the network becomes denser. The denser a network is, the more paths to go from point A to point B exist. In the context of MaaS, this means that competing operators offering transportation services from A to B will have more clients coming from other coopetitors’ routes as the number of routes of coopetitors increases. Then, given a certain density of the transportation network covered by the MaaS scheme, the “winning rides through MaaS” effect will prevail. Second, as the number of possible connections increases, for the reasons evoked above, the MaaS scheme becomes more attractive to users. Since indirect network effects exist, we can expect that, as a result, more operators will join the MaaS scheme, which will in turn attract more users and contribute to render the network denser. Finally, as the number of operators joining the MaaS scheme increases, the operators that are outside of it face an increasing opportunity cost of not joining it, since they lose the rides of the users of the MaaS scheme. Graphically, these three reasons translate into the curve representing the “winning clients through MaaS” effect being over the “losing rides through MaaS” effect one at some value of the x-axis, which we have represented by giving the former an exponential shape and the latter a linear one.

Following this logic, once the network gets sufficiently dense and the user base sufficiently large, operators will have incentives to join the MaaS scheme even if operators of the same mean of transportation with highly overlapping routes also do. This is the case of Go LA, a MaaS app for the city of Los Angeles that comprises, among other operators, two ride-hailing apps (Uber and Lyft). Similarly, in Helsinki, the successful MaaS app Whim includes three rental car companies (Veho, Sixt and Hertz), and two taxi companies (Taksi Helsinki and Lähitaksi).

Conditions of simultaneous data sharing by several operators

As said above, for the MaaS scheme to exist, certain key operators need to have incentives to join it. Moreover, an initial group of transportation operators needs to decide simultaneously whether to join or not. This decision will depend on which other operators join. In terms of Figure 1, this means that the slopes of each operator’s curve will depend on which operators are added to the MaaS scheme. Consequently, the minimal number of other operators in the MaaS scheme that will give a firm an incentive to join (i.e. the point where the two curves meet) will depend on which other coopetitors join. In other words, the mix of transportation operators and the fact that data sharing decisions have to be made simultaneously for a MaaS scheme to emerge need to be taken into account. Therefore, we need to go beyond the logic of a single operator represented in Figure 1. In order to do so, we will recur to a game-theoretical representation that includes the reasoning of the single transportation operator represented in Figure 1. In order to avoid lengthy analytical development, we will use the game represented in Figure 2 as an example that will serve to show which other factors affect the decision of sharing data with coopetitors in MaaS when the mix of transportation operators and the simultaneousness of the data sharing decision are taken into account.

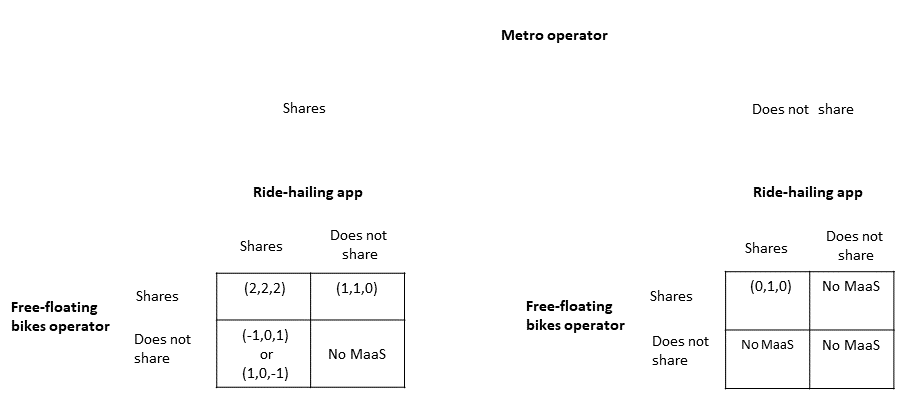

Figure 2. Example of a three-players simultaneous game of data sharing in the context of MaaS

Let us assume there are only three operators in a territory: a free-floating bikes operator, a ride-hailing app and a metro line operator, the latter being the only key one in the sense we have given to this term above. The free-floating bikes operator competes little with the other two, so it has an interest in sharing its data with them as long as at least one of them does too. The metro operator and the ride-hailing app compete with each other in some routes and are complementary in others, so they both have an interest in sharing data only if the other two do too. In that case, the “winning rides through MaaS” overcomes the “losing clients over Maas” effect (i.e. the point of intersection of the two curves of Figure 1 is reached).

The game is simultaneous (every player has to play at the same time) and information is perfect (every player knows what other players have decided and the payoffs associated to each possible outcome). Each operator has two possible strategies: to share or not to share data. Data is only shared with those having chosen to share data as well. The payoffs for each firm represent the number of rides won/lost by coopeting within a MaaS scheme. They are represented between brackets in the following order from left to right: metro operator, free-floating bikes firm and ride-hailing app. The MaaS scheme can only exist in the cases in which at least two players (operators) have positive payoffs.

As we can see, if the metro operator (the key operator) decides not to share its data, the MaaS scheme would only exist if the other two operators share data between each other. Nevertheless, because the ride-hailing app can only gain from sharing its data if the other two do, the MaaS scheme will not exist if the metro operator does not share its data.

If the latter happens, three possibilities arise. If only the ride-hailing app shares its data, either the metro operator or the ride-hailing app would receive a negative payoff and the other one a positive one. Indeed, since their routes overlap considerably and no other operators participate of the MaaS scheme, they can only get clients from each other: it is a zero-sum game. If, on the contrary, only the metro operator and the free-floating bike operator share their data, they both have positive payoffs because their routes are rather complementary: they can both bring more clients than they can capture from each other. Therefore, the MaaS scheme would exist. Finally, if the three share their data, they all have the highest possible payoffs. In this case, the transportation network comprised in the MaaS scheme is dense enough and its user base large enough for the “winning rides through MaaS” effect to win over the “losing rides through MaaS” effect for all transportation operators, even in presence of two operators with rather overlapping routes.

This simple example illustrates two things. First, because the weights of the “losing rides through MaaS” and “winning rides through MaaS” effects for an operator depend on which other operators share their data, and because the launching of a MaaS project requires an initial base of operators deciding simultaneously on sharing their data, multiple mixes of coopeting operators can exist in a MaaS scheme in a territory. In some mixes, not all operators will have incentives to join the MaaS scheme.

Second, certain key transportation operators hold a critical mass of data required for other operators to have incentives to share their data as well. Then, for a MaaS scheme to exist, these key operators have to share their data. This is why virtually all the existing pilots (Compte Mobilité, NaviGoGo, Ubigo, SMILE app…) and operating Maas schemes (Moovel app, Xerox Mobility Marketplace, Whim, Mobility Shop…) include public transportation operators (Jittrapirom et al., 2017), which constitute the core of the transportation network of most cities. Moreover, because they are usually run by state-owned companies or heavily regulated by the State, they can afford to share data even if they will (at least initially) lose more clients than they will win through MaaS because of the positive externalities that this creates for society as a whole (reducing transportation time and traffic jams in a city, diminishing C02 emissions, etc.). For this reason, public transportation operators generally co-develop MaaS projects with private firms (e.g. Go LA app) or even initiate and lead them (e.g. Compte Mobilité, SoMobility).

Discussion

This article represents a first investigation into the determinants of data sharing in the context of inherently coopetitive MaaS schemes. Although our conclusions are consistent with the observed stylized facts in the nascent MaaS projects, two limitations should be taken into account. First, MaaS is in its early years. Experimentations are beginning and business models are being tested. The validity of our conclusions might therefore evolve as new practices emerge. Second, we have not developed the long-term aspect of the coopetitive dilemma, namely the fact that mobility aggregators might use the data obtained from transportation operators to eventually enter their markets. Including such an analysis in further research might not only enrich this investigation, but also nuance the conclusions we have reached by focusing on the short-run. This is all the more relevant because value capture keeps shifting towards data-based services (Bharadwaj, El Sawy, Pavlou, & Venkatraman, 2013) in a business ecosystem in which traditional transportation operators become increasingly ‘datafied’ and new C2C models based on intermediation (carpooling apps, ride-hailing apps) gain terrain.

Moreover, our analysis is based on the assumption that only transportation operators can decide whether to share data or not in order to participate in a MaaS scheme. Nevertheless, article 20 of the General Data Protection Regulation (GDPR), which will become enforceable in the European Union from 25 May 2018, created a right to data portability. Although not all the data required to set up a MaaS scheme is eligible for portability (e.g. data about the schedule of a bus line), other types of data useful to run MaaS schemes (e.g. the record of a person’s use of a ride-hailing app) are. The fact that some mobility data might ‘leak’ outside of the perimeter of the data sharing pool that MaaS requires might affect the decision-making of transportation operators that have to decide whether or not to share data to enter a coopetitive MaaS consortium. This will certainly be an interesting avenue for further research on the topic as the implementation of the GDPR takes place.

Conclusions

MaaS schemes require transportation operators sharing their data with a third-party aggregator and eventually with each other. This creates coopetitive dynamics between them. Some journeys will imply their routes and means of transportation being complementary, which would result in firms cooperating to create and appropriate more value. In other journeys, on the contrary, these firms will compete for rides while still collaborating through data sharing to create more value for end users. In other words, MaaS poses a coopetitive dilemma that comes down to transportation operators having to choose whether to share their data or not. In this paper we have relied on microeconomic theory and the experiences of existing MaaS schemes to investigate the conditions under which they have economic incentives to do so. We can conclude the following:

1. The more complementary an operator’s routes are with those of other operators considering joining/participating in a Maas scheme, the higher weight the “winning rides through MaaS” effect will be relative to that of the “losing rides through MaaS” one and, therefore, the higher the chances that it will decide to coopete with them through data sharing will be. The inverse is true.

2. The higher the number of transportation operators coopeting through data sharing in a MaaS scheme is, the higher the weight of the “winning rides through MaaS” will be over that of the “losing rides through MaaS” effect. Consequently, once a critical mass of operators joins the MaaS scheme, an operator will have incentives to share its data even if other operators strongly competing with it are doing so too.

3. Because the weights of the “losing rides through MaaS” and “winning rides through MaaS” effects for an operator depend on which other operators share their data, and because the launching of a MaaS project requires an initial base of operators deciding simultaneously on sharing their data, multiple mixes of coopeting operators can exist in a MaaS scheme in a territory. Moreover, in some mixes not all operators will have incentives to join the MaaS scheme.

4. Because certain key operators hold data about essential means of transportation in a territory (typically public transportation), if they do not share their data no other operator will have incentives to do so. Therefore, as the vast majority of the existing pilots and operating MaaS scheme show, a successful mix of operators requires the key operators sharing their data.

Bibliographie

Bataille, M., & Steinmetz, A. (2013). Intermodal competition on some routes in transportation networks: The case of inter urban buses and railways. DICE Discussion Paper.

Bengtsson, M., & Kock, S. (2000). ” Coopetition” in business Networks—to cooperate and compete simultaneously. Industrial marketing management, 29(5), 411‑426.

Bharadwaj, A., El Sawy, O., Pavlou, P., & Venkatraman, N. (2013). Digital business strategy: toward a next generation of insights.

Bouncken, R. B., Gast, J., Kraus, S., & Bogers, M. (2015). Coopetition: a systematic review, synthesis, and future research directions. Review of Managerial Science, 9(3), 577‑601.

Brandenburger, A. M., & Nalebuff, B. J. (1997). Co-Opetition: A revolution mindset that combines competition and cooperation: the game theory strategy that’s changing the game of business. Currency Ed.

Chignard, S., & Benyayer, L.-D. (2015). Datanomics. Les nouveaux business models des données. FYP editions.

CIVITAS. (2016, avril 28). Mobility-as-a-Service: A new transport model.

Dagnino, G. B., Le Roy, F., & Yami, S. (2007). La dynamique des stratégies de coopétition. Revue française de gestion, (7), 87‑98.

Hietanen, S. (2014). Mobility-as-a-service. the new transport model, 2‑4.

Jittrapirom, P., Caiati, V., Feneri, A.-M., Ebrahimigharehbaghi, S., González, M. J. A., & Narayan, J. (2017). Mobility-as-a-service: a critical review of definitions, assessments of schemes, and key challenges. Urban Planning, 2(2), 13.

Meurs, H., & Timmermans, H. (2017). Mobility-as-a-service as a multi-sided market: Challenges for modeling.