Citation

L'auteur

Oussama ABIDI

(oussamaabidi5@gmail.com) - (Pas d'affiliation)

Copyright

Déclaration d'intérêts

Financements

Aperçu

Contenu

Artificial Intelligence (AI) is currently reshaping multiple sectors of the global economy, and among the most critical domains is Supply Chain (SC). As the backbone of modern economic systems, SC ensure the flow of goods, services, and information. Disruptions in these systems have historically triggered geopolitical tension, as countries have been increasingly using supply chain dependencies as strategic leverage (transport of medical supplies during COVID-19 (Gereffi, 2020).

Despite its strategic importance, the speed of technological integration in SC remains surprisingly slow. For example, Radio-Frequency Identification (RFID) – a technology initiated around the second world war- is still not widely implemented across key logistics nodes (Attaran, 2007). Similarly, many back-end systems in logistics continue to rely on outdated ERP and legacy platforms. These systems often lack real-time analytics, interoperability, and cloud-native flexibility.

This resistance to modernization is rooted from structural challenges within the industry. Operating on thin profit margins, the companies view major investments as high-risk, leading executives to adopt new technologies only when essential or externally mandated. With limited investment resources, SC firms often prioritize essential expenses such as acquiring and maintaining physical assets—including warehouses, distribution centers, private terminals (e.g., airports, ports), and transport fleets (ships, trucks, trains, aircraft)—as well as investing in their workforce and automation systems. These constraints are compounded by additional barriers, including fragmented supply networks, complex system integration, and the absence of interoperability standards, all of which further increase the risks of investing in this sector (UNCTAD, 2023; WEF, 2022).

Focusing on AI technology, recent marketing narratives and consultancy firms often present its adoption as a rising trend and a promising investment opportunity. However, in practice, deployment remains mostly superficial or confined to pilot projects—mirroring the trajectory of other technologies in this sector. These initiatives are frequently driven more by branding and market positioning than by genuine operational transformation, revealing a clear gap between industry communication and on-the-ground reality (Culot et al, 2024).

The critical step to bridging this gap between communication promises and operational reality is genuine investment in the development and integration of AI within this sector. This leads to the central research question of this paper: “Should SC decision-makers strategically invest in fully integrating AI into their core operations ?”

This question is especially critical in today’s volatile economy, shaped by inflation, trade restrictions, and geopolitical tensions. A misstep in strategic investments could determine whether a SC firm thrives or fails.

To address this challenge, we apply the Strategic Foresight method to explore plausible future scenarios for AI integration in SC, guiding decision-makers toward informed investment choices.

The remainder of this paper is structured as follows: the next section outlines the conceptual framework, including the key steps of strategic foresight and the use of the PESTEL tool. This is followed by the presentation of our results and strategic recommendations.

Conceptual framework

Strategic foresight is a structured, future-oriented method that helps organizations anticipate long-term trends, uncertainties, and potential disruptions in order to inform present-day decision-making. Rather than predicting a single future, it explores multiple plausible scenarios, enabling stakeholders to build resilience environments (AGRIP, 2018). This approach has been widely applied across global sectors, including government, non-governmental, and technology-based organizations.

In the context of SC, strategic foresight provides essential guidance for navigating complex investment decisions related to AI. The process generally involves six key steps: framing the domain, collecting and analyzing inputs (structured in this study using the PESTLE framework to identify high-impact, high-uncertainty drivers (Gehman et al., 2017)), developing plausible scenarios, envisioning their implications, backward planning to define necessary actions, and translating insights into actionable recommendations and strategies.

Recent studies have shown the effectiveness of foresight in examining digital transformation topics such as blockchain, digital twins, and AI (WEF, 2022). In the following section, we present the results of applying this method to our central research question.

Results

In this section, we present the results of applying the strategic foresight method. The first Step frames the domain: this study focuses on AI and SC, two rapidly evolving but unevenly integrated fields. The objective is to assess the possible scenarios of investment in AI in the core SC functions—such as forecasting, procurement, warehousing, and transportation – under conditions of legal uncertainty, fragmented regulation, and technological hype.

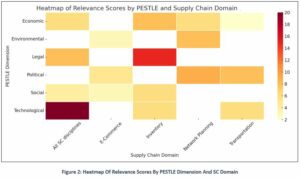

The second and third Steps involve scanning trends and developing foresight scenarios. Using PESTLE analysis, we categorized key ideas across political, economic, social, technological, legal, and environmental dimensions. Each trend was evaluated based on its impact, uncertainty, and resulting relevance. This process helped identify the two most critical and uncertain drivers shaping the future of AI in SC—laying the foundation for scenario development and corresponding investment strategies.

Table 1 : PESTLE analysis of the collected documents

| PESTLE | SC Domain | Key Idea / Trend | Number of mentions in analyzed sources | Impact (1–5) | Uncertainty (1–5) | Relevance |

| Political | Network Planning | Public-private AI infrastructure partnerships. | 4 | 3 | 3 | 9 |

| Food fraud in Africa needs AI/blockchain traceability. | 3 | 2 | 4 | 8 | ||

| Transportation | Localize AI to reduce geopolitical risk. | 3 | 2 | 4 | 8 | |

| E-Commerce | Legal fragmentation blocks SC AI adoption. | 2 | 1 | 5 | 5 | |

| Economic | Inventory | Low R&D and funding gaps limit AI integration. | 5 | 4 | 2 | 8 |

| All SC disciplines | Unrealistic tech expectations lead to disappointment. | 3 | 2 | 3 | 6 | |

| Network Planning | Economic uncertainty slows AI investment. | 3 | 2 | 3 | 6 | |

| Transportation | Predictive AI cuts costs, adoption varies | 2 | 1 | 2 | 2 | |

| Social | Inventory | Generative AI reshapes jobs, reskilling needed | 3 | 2 | 3 | 6 |

| All SC disciplines | User-expectation mismatch delays adoption | 2 | 1 | 4 | 4 | |

| E-Commerce | Trust in sustainable AI-driven SCs still low | 2 | 1 | 3 | 3 | |

| Technological | All SC disciplines | AI/Blockchain mature but lack integration standards | 7 | 5 | 4 | 20 |

| Hype vs. slow adoption of AI/Blockchain in SC | 3 | 2 | 3 | 6 | ||

| Inventory | AI in forecasting, warehousing, simulation varies | 3 | 2 | 3 | 6 | |

| Blockchain/IoT improve traceability, food safety | 4 | 3 | 3 | 9 | ||

| Transportation | AI agents emerging in logistics routing. | 3 | 2 | 3 | 6 | |

| Environmental | Network Planning | AI support Environmental, Social, and Governance (ESG) targets: carbon, circularity. | 3 | 2 | 4 | 8 |

| E-Commerce | AI helps optimize sustainable SC. | 2 | 1 | 3 | 3 | |

| Legal | Inventory | AI face legal hurdles in traceability & governance | 4 | 3 | 5 | 15 |

| AI traceability faces regulatory & privacy issues | 2 | 1 | 5 | 5 | ||

| All SC disciplines | Responsible AI raises legal concerns (liability, explainability) | 3 | 2 | 4 | 8 |

From this list of key ideas, we can identify the Top two Critical Drivers for Scenario Building :

- Technological Maturity and Integration Gaps (Relevance Score: 20)

AI, blockchain, and optimization tools are rapidly advancing, but their integration into SC remains inconsistent due to a lack of standards of system integration. - Regulatory Frameworks (Relevance Score: 15)

AI introduces complex challenges around data traceability, responsibility, and regulation, making the legal environment a key source of uncertainty that significantly affects companies’ decision of investment.

With both these high score subjects, we can map a matrix of 2×2 with 4 plausible scenarios :

Table 2 : Matrix 2×2 with 4 plausible scenarios

| High Tech Integration | Low Tech Integration | |

| High Legal Clarity | High Tech Integration, High Legal Clarity (The Smart SC) | Low Tech Integration, High Legal Clarity (Locked Potential) |

| Low Legal Clarity | High Tech Integration, Low Legal Clarity (Unregulated Development) | Low Tech Integration, Low Legal Clarity (Frozen SC) |

In the fourth and fifth steps of the strategic foresight method, we detail each identified scenario and Backward planning to determine the policies, investments, and decisions required to reach or avoid those futures.

Table 3 : Scenarios narratives and backward planning

| Scenario 1: The Smart Chain | Scenario 2: Unregulated Development | Scenario 3: Locked Potential | Scenario 4: Frozen SC | |

| Narratives | AI is smoothly integrated into SC, supported by robust regulatory frameworks that enable secure data sharing, auditability, and legal protection. | SC actors rapidly adopt advanced AI tools amid legal ambiguity. In the absence of clear regulations, shadow AI practices proliferate, data privacy becomes inconsistent, and liability remains unclear. | Although AI and data governance regulations are well-defined, supply chains struggle to adopt the technology due to legacy systems, lack of interoperability, limited investment capacity, and workforce resistance. | Neither technological readiness nor regulatory clarity is achieved, leading to delayed AI adoption, and persistent uncertainty. |

| Stakeholders | Governments, logistics firms, AI vendors, ESG auditors. | Startups, early adopters, fragmented regulators. | Policymakers, IT consultants. | Public watchdogs, legacy system vendors, compliance officers. |

| Opportunities | Strong public-private collaboration drives responsible AI investment and resilient SC. | Fast innovation gives early adopters a competitive edge. | Legal groundwork enables future readiness. | Low-cost legacy systems remain stable in the short term. |

| Risks | investment amount may exclude smaller players. | Lack of regulations leads to misuse, reputational damage, and litigation. | SC firms delay investment waiting for tech to mature, losing efficiency and relevance. | Firms fall behind globally. |

| Winners | Firms investing early in AI with compliance strategies; governments that lead regulation. | Agile tech firms, startups, and risk-tolerant investors. | Legal advisors, consultancies, slow adopters maintaining compliance. | Legal consultants, legacy software providers. |

| Losers | Tech-resistant firms and states with weak innovation policy. | Governments unable to regulate; conservative SC players. | Tech vendors waiting for integration. | Innovative firms; talent fleeing stagnant sectors. |

| Real-life Cues Showing These Futures Are Emerging | European AI Act enforcement, public-private AI investment programs. | Generative AI rapidly integrated into SC, informal logistics optimization | Proliferation of national AI strategies with limited business buy-in, delayed ERP modernization projects. | Withdrawal from AI pilot programs, Pilot project stagnation. |

The foresight scenarios outlined above are not distant abstractions, they directly inform today’s investment decisions. Each potential future demands a balance between technological readiness and legal clarity. The backward planning exercise shows that passive delay increases risk, while proactive steps—especially in workforce training, governance, and phased AI adoption—can build resilience and competitive edge. The following section offers targeted investment strategies based on these.

Recommendations

In this last step of the Strategic foresight method, the goal is to use the above different scenarios to formulate the different possibilities and recommendations of investment for the SC decision-makers.

Table 4: investment decision

| Scenario Alignment | Investment Decision | Pros of investment | Cons of investment |

| The Smart Chain | Heavy, strategic investment | First-mover advantage; operational efficiency; strong data use case | High investment risk; financially burden in volatile environments |

| Locked Potential | Low investment | Time to evaluate trends and train workforce; raises awareness on AI risks | Missed early-mover benefits; potential workforce resistance if training delayed |

| Unregulated Development or Locked Potential | Moderate investment with phased adoption | Balances marketing presence and internal preparation; allows trend monitoring | Late to adopt innovations; higher future catch-up costs |

| Frozen SC | No investment in AI | No R&D cost; conservative financial strategy | Missed optimization opportunities; risk of shadow AI usage and security breaches |

Now that the various investment scenarios have been presented, we turn to answer our central research question.

Currently, the technological landscape—driven by private actors—is advancing faster than regulatory frameworks established by official authorities. This mismatch places us in the « Unregulated Development » scenario. Under such conditions, companies should lean toward a moderate investment strategy. It is no longer viable for SC firms to ignore AI entirely; at the very least, basic investment is necessary, particularly in the training of workforce, to mitigate security risks posed by the informal use of AI tools and to build internal awareness. Establishing a monitoring or follow-up committee is also recommended to stay informed about emerging trends, tools, and risks in the AI domain.

Looking ahead, the investment landscape will evolve alongside legal and technological progress. In scenarios where regulatory clarity and technological maturity converge, supply chain (SC) firms may struggle to keep pace without public support. Government intervention is therefore essential—whether through direct funding or enabling legislation—to level the playing field and support smaller firms in competing with tech giants. For instance, the Chinese government has invested in multiple companies and innovation hubs in cities like Shenzhen and Hangzhou to support AI-driven logistics (NSDPI, 2025). Military investments can also accelerate AI development in supply chains, particularly given the strategic importance of defense logistics. However, there are notable exceptions in the private sector, such as Amazon, which is pursuing ambitious AI projects—including the development of a next-generation generative AI foundation model aimed at improving robotic fleet efficiency (Dresser, 2025).

Finally, it’s important to emphasize that AI investment strategies cannot be one-size-fits-all. Instead, each SC firm must tailor its approach based on a combination of internal and external factors, including:

- Degree of exposure to the end customer: Front-end systems (e.g., e-commerce platforms) may justify stronger investment due to customer visibility. In contrast, back-end applications require careful evaluation.

- Operational cost impact: High-cost operations may benefit significantly from AI-driven optimization.

- Task complexity: Complex organizational workflows may offer more value when supported by AI technologies.

Bibliographie

- Attaran, M. (2007). RFID: An enabler of supply chain operations. Supply Chain Management: An International Journal, 12(4), 249–257. https://doi.org/10.1108/13598540710759763

- Association of Governmental Risk Pools (AGRiP). (2018). Framing the future: A guide to strategic foresight. https://higherlogicdownload.s3.amazonaws.com/AGRIP/613d38fc-c2ec-4e1a-b31f-03fa706321aa/UploadedImages/documents/AGRiP_Workbook_FramingTheFuture_FINAL.pdf

- Culot, G., et al. (2024). Artificial intelligence in supply chain management : A systematic literature review of empirical studies and research directions. Computers in industry, 162. https://www.sciencedirect.com/science/article/pii/S0166361524000605

- Dresser, S. (2025). Amazon has more than a million robots and is building a new AI foundation model to make them smarter. About Amazon. https://www.aboutamazon.com/news/operations/amazon-million-robots-ai-foundation-model

- Gehman, J., Glaser, V. L., Eisenhardt, K. M., Gioia, D., Langley, A., & Corley, K. G. (2018). Finding theory-method fit: A comparison of three qualitative approaches to theory building. Journal of Management Inquiry, 27(3), 284–300. https://doi.org/10.1177/1056492617706029

- Gereffi, G. (2020). What does the COVID-19 pandemic teach us about global value chains? Journal of International Business Policy, 3, 287–301. https://doi.org/10.1057/s42214-020-00062-w

- National Security Data and Policy Institute (NSDPI). (2025). China’s AI-ML data environment: Ambitions, opportunities, and limitations. https://nationalsecurity.virginia.edu/sites/nationalsecurity/files/2025-06/00013_%2820250513%29_NSDPI_China%27s%20AI-ML%20Data%20Environment-%20Ambitions%2C%20Opportunities%2C%20and%20Limitations.pdf

- United Nations Conference on Trade and Development (UNCTAD). (2023). Digital economy report 2023. https://unctad.org/webflyer/digital-economy-report-2023

- World Economic Forum (WEF). (2022). Charting the course for global value chain resilience. https://www.weforum.org/publications/charting-the-course-for-global-value-chain-resilience

il ne peut pas avoir d'altmétriques.)