Citation

L'auteur

Sébastien Bourbon

- IAE Lyon School of Management – Université Jean Moulin Lyon 3

Copyright

Déclaration d'intérêts

Financements

Aperçu

Contenu

Theorical approach: towards a more proactive interpretation of rent

Cognitive rent is an “intangible capital constituted through the accumulation, transformation and creation of implicit and explicit knowledge that gives a competitive advantage in a given market and/or a favourable position in a relationship with an interlocutor” (Bourbon, 2020)

Discussions on the existence of cognitive assets and knowledge as intangible business capital is not new (Penrose, 1959). At first sight, the concept of cognitive rent could be likened to the knowledge-based rent concept developed by Spender (1996). However, it is very different, and this author argues that knowledge-based rent is motionless. On the contrary, cognitive rent is dynamic, and a company’s cognitive rent will develop according to the overall evolution of knowledge on a market, and among competitors.

Cognitive rent is also distinguished from the paradigms of the resource-based theory of the firm by the idea of a conscious and organised exploration of market knowledge. Recent developments in this theory of the firm have begun to discuss the internal exploration of knowledge, that is, within the company and with employees. (Burger Helmchen, & Frank, 2011). However, these analyses do not take into account the market – and the actors who are part of it – as a valuable source of knowledge to be explored, while the cognitive rent is built up in the first place through exchanges with interlocutors outside of the company. Moreover, the cognitive rent can be a response to Porter’s vision of business strategy criticising the resource-based theory of the firm for being focused on the internal dynamics and not sufficiently connected to the market (Amesse, F., Avadikyan, A., & Cohendet, 2003).

Cognitive rent also confirms the need to go beyond information rent, at a time when digital technology is democratizing access to a broad spectrum of information (Tewksbury, & Rittenberg, 2012). It is made up of the four forms of knowledge proposed by Lundvall and Johnson (1994) and readjusted to make them more operational for companies exploring knowledge in a market, as follows: procedures (know-what), skills (know-why), expertise (know-how) and experience (know-who). The first two forms relate to formal and explicit knowledge, while the last two relate to poorly codified and tacit knowledge.

A firm’s exploration of a cognitive rent does not quite meet the same goals as those of a company whose strategy based on the resource-based theory. It does not seek to set up organisational routines (Lambert, 2013), nor to ensure a reduction in transaction costs through another form of governance (Rindfleisch, 2019). The approach involves identifying knowledge asymmetries not just exclusively within the company, as Denis (2014) has suggested, but also with other market players.

The operational approach. A tool for exploring cognitive rent

A user’s guide to exploring cognitive rent

This article suggests companies use a tool to help them seek out and measure knowledge asymmetry, and finally to explore cognitive rent (Bourbon, 2020a). The tool . Firstly, it qualifies and measures knowledge asymmetry through a questionnaire and a matrix modelled on the Karasek matrix. Secondly, it makes suggestions for positioning the company on the market according to the asymmetry identified in a configuration table. Thirdly, the tool includes company knowledge management measurements depending on the positioning to be adopted.

The tool can then help the company to build up its cognitive rent as follows: the results of the questionnaires make it possible to know what type of knowledge the company must put into practice or acquire to respond to the knowledge asymmetry identified among the actors questioned. Then, the matrix facilitates the reading of the questionnaire results according to the four categories mentioned above (procedures, skills, expertise, experience). Finally, the information obtained also helps to create a database on the need for knowledge about part or all of the market.

Putting the tool into practice with new real estate buyers

The tool was put into practice with clients of IFIC Immobilier group who were looking for a new property. It illustrates the sources of knowledge asymmetries that a real estate agent can benefit from.

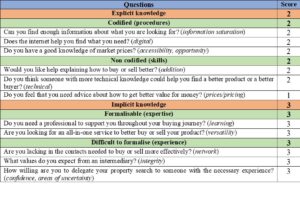

Figure 1. Questionnaire

Results of the questionnaire made it possible to fill in the matrix and the configuration table as below.

Figure 2. The matrix and the configuration table

Strategic positioning suggested by the tool

The questionnaire revealed an asymmetry among clients concerning tacit forms of knowledge, guiding the real estate agent in how best to use their own professional expertise and experience. The agent thus adopted a supportive positioning vis-à-vis these market players. The agent then took indicated knowledge management measures (in-house training, best-practice sharing) after carrying out an in-house knowledge check to find out to what extent they can bridge this knowledge asymmetry. The tool also had a strategic purpose, with the results providing the agent with information supporting an intuition that it was preferable to offer a real estate service rather than just offering real estate for sale. As a result, depending on the needs of the customer, the agent either provides a partial or total support service in their search for new property.

A more refined market approach

Cognitive rent as a major source of causal ambiguity

Use of the tool shows how the exploration of knowledge asymmetry can be an innovative market approach that is ignored by competitors, and therefore, a source of causal ambiguity, that is to say, “a lack of understanding of cause-and-effect interactions between resources and competitive advantage” (McIever & Lengnick-Hall, 2018, p. 304). By using knowledge asymmetry as another unit of analysis, the company will set itself apart from its competitors. Through this process, it acquires a distinctive competence: the ability to build up a cognitive rent in a conscious and organised way by using an effective tool, as well as the ability to find knowledge asymmetries on which to position the company.

The need for a diversified and renewed cognitive rent

The tool described above was put into practice on a group of new customers. To obtain greater benefit for developing a (new) market strategy, this approach should be repeated for the full range of clients in order to establish a map of market knowledge asymmetries and to enable the company to adapt its positioning accordingly. In addition to this multidirectional exploration approach, we must ensure there is a variety of cognitive rent, involving a balance between the four forms of knowledge already discussed above, namely procedures, skills, expertise and experience. This variety of cognitive rent also protects companies against the risk of platformisation. Indeed, a platform and an algorithm cannot constitute a high-quality cognitive rent for lack of tacit knowledge.

Additional indications for the development of the business strategy

Building up a cognitive rent is of great interest to companies, providing valuable strategic decision-making support concerning which market approach to take. It adds to and deepens the information obtained from other tools, such as Key Success Factors or Porter’s 5 Forces. By exploring knowledge asymmetries upstream, a company can thus discover whether it can diversify or invest in a given market. The process of exploring a diversified and robust cognitive rent can be a bonus for SMEs to the extent that they have elements of tacit knowledge that large groups do not have, which offers them two strategic opportunities: either to position themselves in niche and original markets, or to “monetise” their cognitive income by playing the intermediary for large companies wishing to gain access to a specific local market.

Bibliographie

Amesse, F., Avadikyan, A., & Cohendet, P. (2003), Resources and Competences Perspectives on Strategy of the Firm: A Discussion of the Central Arguments. Contract of the European Union. 1st workshop, Strasbourg.

Bourbon, S. (2020), La rente cognitive, une valeur refuge en temps de crise, Management & Data Science.

Bourbon, S. (2020a), Vaincre l’ubérisation par l’asymétrie de connaissances et la rente cognitive, EMS.

Burger Helmchen, T., & Frank, L. (2011), The Creation of Revenue: An Approach by Competencies and Dynamic Capabilities, Innovations, vol.2, n°35, pp.89-111.

Denis, J-P. (2014), Hip-hop management, EMS.

Lambert, G. (2013), A strategic management of forgetting, in Burger Helmchen, T. (Eds.), The Economics of Creativity, Routledge, pp.20-40.

McIver, D., Lengnick-Hall, C. (2018), The causal ambiguity paradox: Deliberate actions under causal ambiguity, Strategic Organization, vol.16, n°3, pp.304-322.

Oliveira Vieira, E.A., Moreira Cunha, D. & Martinez Verdier, M-L. (2013), Internet la démocratisation de l’information, 3ème Colloque International de l’ARCD à Marseille, pp.1-9

Penrose, E. T. (1959), The Theory of the Growth of the firm, Oxford University Press.

Rindfleisch, A. (2019), Transaction cost theory: past, present and future, AMS Review, vol.10, pp.85-97.

Spender, J. C. (1996), Making knowledge the basis of a dynamic theory of the firm, Strategic

Management Journal, vol.17, pp.45-62.

Tewksbury, D. & Rittenberg, J. (2012), News on the Internet: Information and Citizenship in the 21st Century, Oxford University Press.